Understanding Cryptocurrency Risks and Rewards

Cryptocurrency has changed our opinion on cash and ventures. From Bitcoin to Ethereum, these computerized monetary standards guarantee significant yields and advancement. Notwithstanding, they likewise accompany huge risks. Understanding Cryptocurrency risks and rewards is essential prior to plunging into this unstable market. This guide makes sense of the advantages and difficulties of digital forms of money, assisting you with pursuing informed choices.

What is Cryptocurrency?

Cryptocurrency is a computerized or virtual cash got by blockchain innovation. Not at all like conventional cash, it works freely of national banks.

Well known cryptographic forms of money include:

- Bitcoin (BTC): The first and most broadly perceived cryptocurrency.

- Ethereum (ETH): Known for shrewd agreement usefulness.

- Ripple (XRP): Zeroed in on quick, minimal expense global installments.

While crypto offers invigorating open doors, gauging the risks against the rewards is significant.

Rewards of Cryptocurrency

Digital currencies stand out in light of multiple factors. Here are a few key advantages:

1. Potential for High Returns

Digital forms of money have shown unbelievable development. Bitcoin, for instance, flooded from a couple of dollars to several thousands in esteem. Early adopters of effective coins have received enormous benefits.

2. Decentralization

Most digital currencies work on decentralized networks. This implies no single element controls the framework, decreasing risks of oversight or control.

3. Straightforwardness and Security

Blockchain innovation, the foundation of digital forms of money, keeps all exchanges in a straightforward and secure record. This diminishes misrepresentation and guarantees trust in the framework.

4. Availability

Anybody with web access can put resources into cryptographic forms of money. This opens up monetary open doors for individuals who might not approach customary financial frameworks.

5. Various Use Cases

Digital forms of money have applications past exchanging. Ethereum empowers decentralized applications (DApps), while stablecoins give low-unpredictability choices to exchanges.

Risks of Cryptocurrency

While the rewards are engaging, digital forms of money convey huge risks.

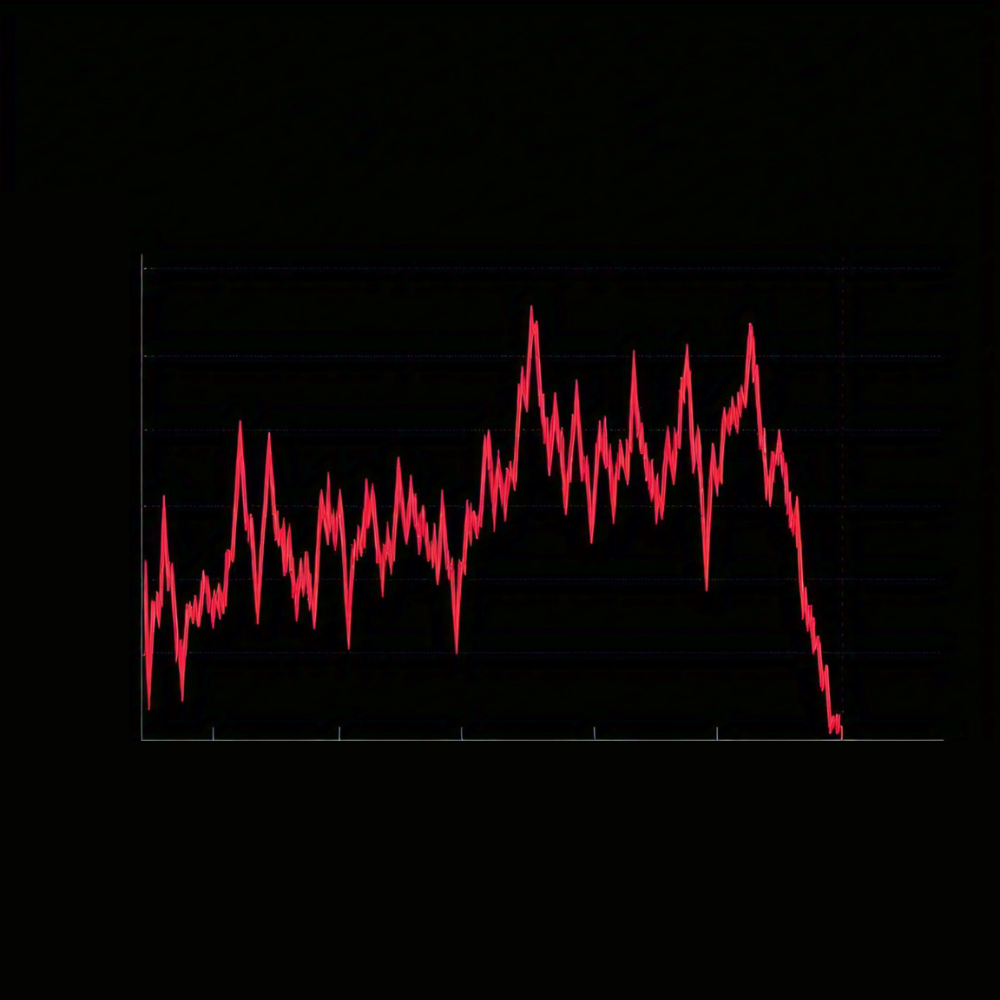

1. Unpredictability

Crypto markets are profoundly unpredictable. Costs can skyrocket or plunge in no time. This makes it trying to anticipate returns and expands the gamble of misfortunes.

2. Administrative Vulnerability

Legislatures overall are as yet sorting out some way to control digital forms of money. New regulations or boycotts can influence the market and influence your ventures.

3. Security Risks

However blockchain is secure, crypto trades and wallets are defenseless against hacking. Whenever hacked, you could lose your assets with no real way to recuperate them.

4. Absence of Purchaser Insurance

Not at all like customary banking, digital money needs solid customer assurances. On the off chance that an exchange turns out badly, there’s many times no response.

5. Intricacy

Cryptocurrency includes specialized language and complex cycles. For novices, grasping wallets, confidential keys, and blockchain can dismay.

Tips to Mitigate Risks

In spite of the risks, you can do whatever it takes to capably put resources into digital money.

1. Do all necessary investigation

Prior to financial planning, find out about the particular cryptocurrency you’re keen on. Grasp its motivation, innovation, and market patterns.

2. Broaden Your Ventures

Try not to place all your cash into one coin. Spread your ventures across various digital forms of money to diminish risk.

3. Begin Little

In the event that you’re new to crypto, begin with a little speculation. Just put away cash you can bear to lose.

4. Utilize Secure Wallets

Store your cryptocurrency in secure wallets, ideally equipment wallets, to safeguard against hacking.

5. Remain Informed About Guidelines

Stay aware of administrative advancements in your country. Changes parents in law can essentially affect the crypto market.

Balancing Risks and Rewards

Cryptocurrency isn’t the best thing in the world everybody. In any case, for those ready to explore its intricacies, it offers open doors for development.

Pose yourself these inquiries prior to money management:

- Am I arranged for market unpredictability?

- Do I comprehend the risks implied?

- Might I at any point stand to lose my speculation?

Via cautiously assessing your monetary objectives and chance resistance, you can choose if crypto is an ideal choice for you.

Common Mistakes to Avoid

Many individuals commit expensive errors while putting resources into cryptocurrency. This is what to keep away from:

- Pursuing Publicity: Don’t put resources into a coin since it’s moving. Research completely prior to deciding.

- Disregarding Security: Consistently utilize secure wallets and empower two-factor confirmation.

- Over-Utilizing: Try not to acquire cash to put resources into crypto. Market slumps can prompt critical misfortunes.

- Absence of Tolerance: Digital money isn’t a pyramid scheme. Long haul systems frequently work better.

End

Conclusion

Cryptocurrency offers a universe of conceivable outcomes, however it’s not without challenges. By understanding cryptocurrency risks and rewards, you can move toward the market with mindfulness and certainty.

Make sure to do exhaustive examination, differentiate your speculations, and focus on security. While the excursion might be eccentric, informed choices can assist you with opening the capability of this interesting computerized boondocks.

Whether you’re an inquisitive fledgling or a carefully prepared financial backer, balance is vital. Move toward the market with care, and you could find that the rewards offset the risks.