The Rise of Decentralized Finance: What You Need to Know

The monetary world is advancing. The rise of decentralized finance (DeFi) is reshaping our opinion on cash and banking. Based on blockchain innovation, DeFi offers an option in contrast to customary monetary frameworks.

This developing pattern is tied in with making finance open, secure, and straightforward. However, what precisely is DeFi? Furthermore, for what reason is it acquiring such a lot of consideration? How about we make a plunge?

What is Decentralized Finance (DeFi)?

Decentralized Finance, or DeFi, alludes to a framework where monetary administrations work without delegates like banks. All things being equal, DeFi utilizes blockchain innovation and brilliant agreements.

This is the carefully guarded secret:

- Blockchain: A decentralized record records exchanges safely.

- Shrewd Agreements: Self-executing contracts mechanize arrangements without the requirement for outsiders.

DeFi stages permit clients to loan, acquire, exchange, and contribute straightforwardly, without depending on concentrated establishments.

For what reason is DeFi Developing?

The rise of decentralized finance is energized by a few elements:

1. Availability

Customary money frequently prohibits those without admittance to banks. DeFi disposes of hindrances, permitting anybody with a web association with take an interest.

2. Straightforwardness

Blockchain innovation guarantees all exchanges are recorded openly. This decreases extortion and increments trust.

3. Control

DeFi gives clients command over their resources. Not at all like banks, you hold the keys to your assets.

4. Advancement

DeFi stages offer inventive monetary arrangements. From decentralized loaning to yield cultivating, there’s many open doors.

5. Worldwide Reach

DeFi is borderless. It permits clients from any country to get to similar monetary administrations.

Key Features of DeFi

DeFi stages offer special highlights of real value:

1. Decentralized Trades (DEXs)

DEXs empower clients to exchange cryptographic forms of money straightforwardly, without go-betweens. Models incorporate Uniswap and SushiSwap.

2. Loaning and Acquiring

Stages like Aave and Compound let clients loan or acquire crypto resources. Loan specialists acquire interest, while borrowers give guarantee.

3. Stablecoins

Stablecoins like USDC and DAI diminish instability. They are attached to the worth of stable resources like the U.S. dollar.

4. Yield Cultivating

Yield cultivating permits clients to procure awards by giving liquidity to DeFi conventions.

5. Decentralized Applications (DApps)

DApps are applications based on blockchain. They offer different administrations, from gaming to back.

Benefits of DeFi

The rise of decentralized finance accompanies many benefits:

1. Independence from the rat race

DeFi eliminates the requirement for banks and controllers. You control your cash and choose how to utilize it.

2. Lower Expenses

Without go-betweens, DeFi diminishes exchange charges. This is particularly helpful for cross-line exchanges.

3. Development Open doors

DeFi makes space for novel thoughts and innovations. Designers can construct stages that reclassify monetary frameworks.

4. Acquiring Potential

Clients can acquire interest, rewards, or benefits through loaning, marking, and exchanging.

Challenges of DeFi

In any case, DeFi isn’t without its dangers:

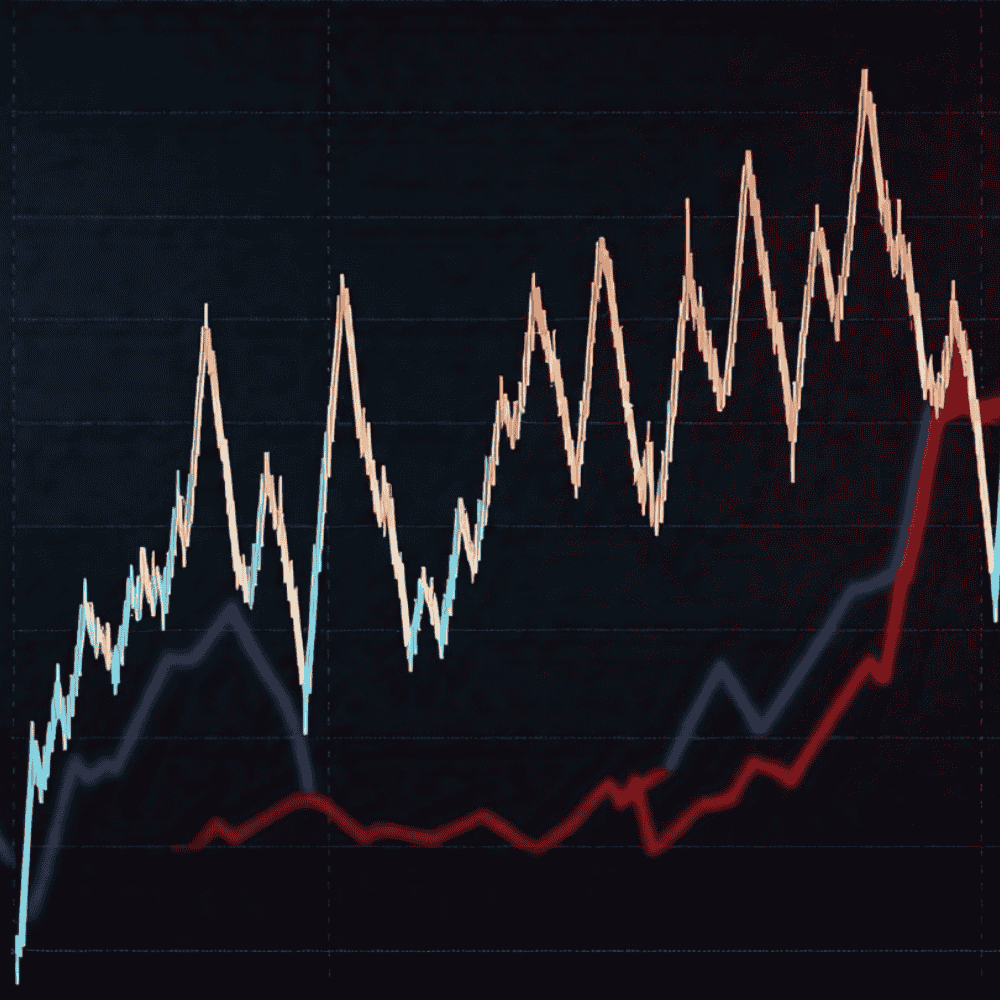

1. Unpredictability

Digital currency markets are eccentric. Resource values can vary essentially.

2. Security Dangers

Brilliant agreements can have bugs. Programmers might take advantage of weaknesses, prompting misfortunes.

3. Administrative Vulnerability

Legislatures are as yet sorting out some way to control DeFi. Future regulations could influence its development.

4. Intricacy

DeFi can be overpowering for newbies. Figuring out wallets, keys, and stages takes time.

5. Tricks and Misrepresentation

Not all DeFi projects are genuine. Clients should investigate completely prior to money management.

How to Get Started with DeFi

Assuming that you’re keen on investigating decentralized finance, follow these means:

1. Gain proficiency with the Essentials

Comprehend blockchain, brilliant agreements, and how DeFi stages work.

2. Pick a Wallet

Utilize a protected crypto wallet like MetaMask or Trust Wallet to store your resources.

3. Research Stages

Not all DeFi stages are made equivalent. Pick legitimate ones with solid security records.

4. Begin Little

Contribute just what you can bear to lose. Start with limited quantities to limit risk.

5. Remain Informed

The DeFi space advances quickly. Pursue industry news to remain refreshed on directions and dangers.

DeFi’s Future Potential

The rise of decentralized finance is only the start. DeFi can possibly:

- Reform worldwide financial frameworks.

- Enable people in underbanked locales.

- Cultivate monetary incorporation around the world.

Nonetheless, for DeFi to arrive at its maximum capacity, challenges like guideline and security should be tended to. With time, the business is supposed to develop, offering greater strength and trust.

Conclusion

The rise of decentralized finance is reshaping the way that we communicate with cash. By killing mediators, DeFi engages people and advances development.

While it offers energizing open doors, moving toward DeFi with caution is significant. Research completely, begin little, and consistently focus on security.

DeFi addresses a shift toward a more open and comprehensive monetary framework. Whether you’re a financial backer, engineer, or inquisitive onlooker, understanding its dangers and prizes is critical to settling on informed choices.

As this space keeps on developing, its effect on the worldwide economy will probably be significant. The inquiry is: Would you say you are prepared to embrace the eventual fate of money?